Volvo’s "Care by Volvo" subscription service launched with a bold vision: to provide a flexible, hassle-free alternative to car ownership. By bundling insurance, maintenance, and taxes into a single monthly payment, they aimed to simplify mobility for premium customers while pioneering the car subscription model in their segment.

The premise was straightforward, rather than navigating complex financing or lease agreements, customers could subscribe to a Volvo for a fixed monthly fee, gaining access to a fully serviced car without long-term commitments. The model capitalised on the growing trend of subscription-based services at the time.

However, despite its ambitious goal Care by Volvo faced significant roadblocks which have ultimately led to its recent withdrawal from certain markets, including the United States. Issues such as conflicts with dealer networks, a lack of flexibility, and pricing misalignment hindered its growth and adoption. In this article we'll explore these factors and what other OEMs and mobility providers can learn from Volvo's experience. Importantly, this isn’t a case against car subscriptions as a concept but rather an analysis of how execution determines success.

The Rise of Car Subscription Products

The automotive industry has been evolving towards more flexible mobility solutions, with consumers increasingly valuing convenience, adaptability, and digital-first experiences.

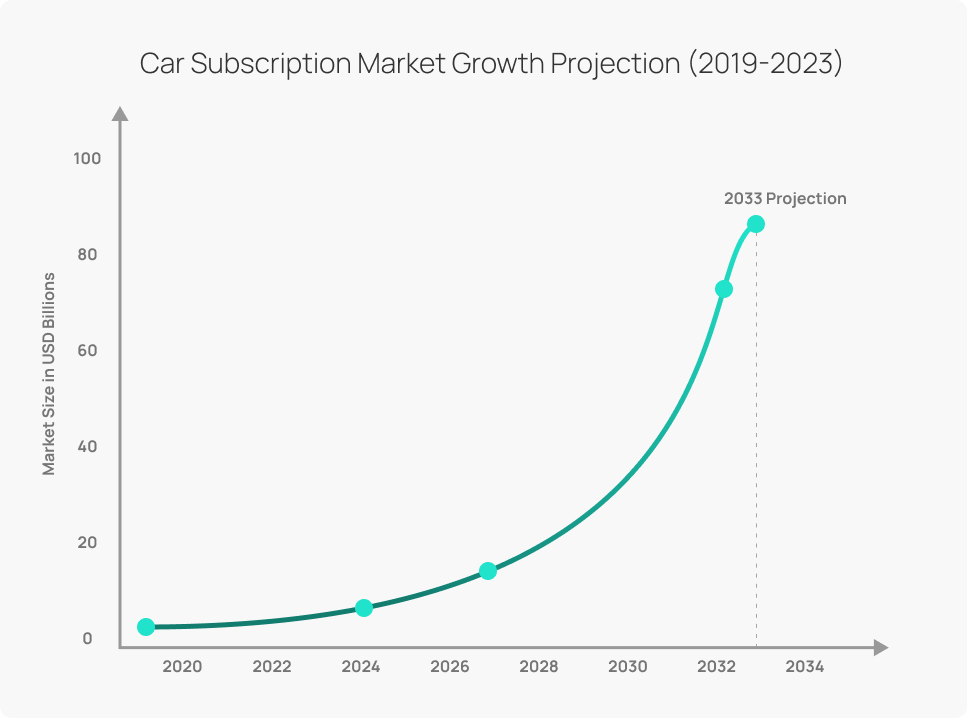

Globally, the car subscription market is forecast to expand from $3.55 billion in 2020 to $12.1 billion by 2027, reflecting aa annual growth rate of 23.12%. This substantial predicted growth indicates a strong demand for subscription-based services, provided the offerings align with consumer expectations in terms of cost, flexibility, and ease of use.

What Was Care by Volvo?

Volvo introduced Care by Volvo in 2017, positioning it as an all-inclusive, premium car subscription service. The model was intended to bridge the gap between traditional leasing and outright ownership, offering a simplified, digital-first alternative. They were truly one of the first OEMs to offer this kind of service.

The premise:

By paying a fixed monthly fee, subscribers received access to a brand-new Volvo vehicle with bundled services, including:

- Comprehensive insurance – Eliminating the hassle of finding and managing a separate insurance policy.

- Maintenance and servicing – Covering scheduled maintenance and wear-and-tear items.

- Registration and taxes – Included in the monthly cost, reducing administrative burden.

- Online sign-up and minimal paperwork – A digital-first approach designed to streamline the customer experience.

- Fixed terms with upgrade options – Customers could switch to a new vehicle after a designated period

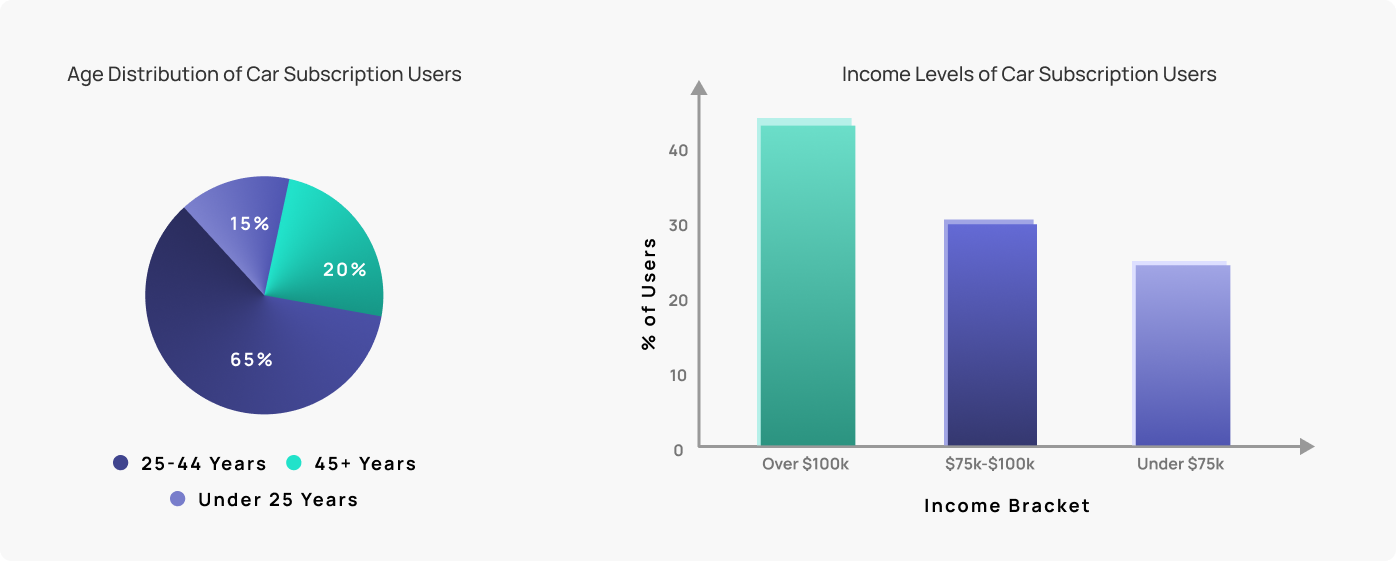

The model primarily targeted high-income, convenience-driven consumers who valued an effortless, commitment-free approach to mobility. It was also positioned to attract younger, tech-savvy urban dwellers who might be less inclined towards traditional car ownership.

How Volvo’s Approach Differed

While car subscriptions as a whole have gained more momentum recently, Volvo’s early version and execution had notable distinctions that shaped its market reception:

- Pricing Strategy – Volvo positioned its model as a premium product. This limited its appeal to a niche audience willing to pay a higher price for bundled services.

- Lack of Customisation – Successful subscription models, include options for vehicle swaps, flexible contract lengths, and self-service modifications. Volvo’s rigid structure lacked these features, reducing its appeal to users expecting adaptability.

- Dealer Conflicts – Unlike Tesla’s direct-to-consumer approach, Volvo’s model operated within an established dealership network, creating tensions around commission structures and business priorities. Many dealers were reluctant to promote subscriptions over traditional leasing and financing deals, which provided them with better profit margins.

Additionally, the rise of self-service features in subscriptions has demonstrated significant benefits. Data from Tomorrow's Journey customers indicates an 85% increase in subscription extensions after enabling more self-serve options, such as plan modifications and term flexibility. Volvo’s rigid terms meant customers had fewer opportunities to personalise their experience, which limited engagement and retention.

In comparison, brands such as Lynk & Co have implemented more adaptable subscription services, providing customers with:

- Shorter commitment periods – Monthly options that allow cancellation without penalties.

- Vehicle swaps – The ability to change models based on needs.

- Lower price points – More competitive pricing structures that offer better perceived value.

By contrast, Care by Volvo remained relatively high-cost, with limited incentives for long-term engagement. The lack of tiered pricing or customisable features contributed to its struggle in retaining customers beyond their initial subscription period.

While Volvo’s exit from the car subscription market may suggest challenges, it does not signal the failure of the model itself. Instead, it highlights the need for flexibility, alignment with dealer incentives, and competitive pricing strategies. Successful car subscription services must offer adaptable plans, allow vehicle swaps, and integrate self-service features to drive retention.

For OEMs and mobility providers exploring subscription models, Volvo’s experience offers valuable insights into what works, and what doesn’t. As the industry continues shifting towards digital mobility solutions, companies that prioritise customer-centric, flexible, and competitively priced subscription models will likely emerge as leaders in this space.

Key Challenges Faced by Care by Volvo

Conflict Between Dealer Motives and Subscription Flexibility

One of the biggest hurdles for Care by Volvo was the disconnect between Volvo’s corporate objectives and its dealer network. Traditional dealerships operate on a commission-based model, with significant revenue coming from vehicle sales and financing. Subscription models, however, introduce a different revenue structure, often requiring dealers to adapt their business models.

Why It Was a Problem:

- Profitability Concerns: Dealers typically earn more from traditional financing and leasing than from subscriptions. Since Care by Volvo provided a lower-margin alternative, it was less attractive for dealers to promote. Unlike leasing, where dealerships could secure substantial backend profits through financing agreements, subscriptions offered little room for dealer upselling.

- Resistance to Change: Many dealers seemed hesitant to embrace a new model that disrupted their existing workflows and profit structures. Selling a subscription required a different customer engagement approach, and many sales teams were not adequately incentivised or trained to push the new model over traditional financing options.

- Limited Buy-In: Unlike direct-to-consumer subscription models, Volvo still relied on dealers for fulfilment, leading to inconsistent execution. Since dealers were not the primary beneficiaries of subscription success, the motivation to drive customer adoption was limited. This created friction between Volvo's ambitions for the program and the willingness of its dealer partners to actively support it.

- Broader Industry Challenge: The challenges Volvo faced are not unique. Many OEMs experimenting with subscriptions struggle to align their models with dealer interests. Companies that have found success, have done so by circumventing the dealership model altogether and operating direct-to-consumer sales channels.

Lack of Flexibility Compared to Competitors

Flexibility is one of the key selling points of car subscription services, particularly for modern consumers who seek customisation and convenience. However, Care by Volvo lacked some of the adaptable features that have made other subscription models successful.

Challenges with Volvo’s Model:

- Rigid Term Lengths: Unlike services that allow short-term swaps or rolling monthly contracts, Care by Volvo had fixed durations with limited flexibility. Customers who wanted shorter commitments or the ability to upgrade mid-term found the program restrictive.

- No Vehicle Swaps: A major advantage of car subscriptions is the ability to switch between models to accommodate changing needs. Volvo’s model did not include vehicle swaps, making it less appealing compared to alternatives, which offer greater flexibility in vehicle selection.

- Limited Self-Service Features: Many successful subscription models enable customers to manage their plans digitally, from upgrades to early exits. Volvo’s offering lacked a robust self-service platform, reducing customer autonomy.

Pricing Misalignment with Consumer Expectations

Subscription models work best when customers perceive clear value. While Care by Volvo positioned itself as a premium product, its pricing did not always align with consumer expectations.

Key Pricing Issues:

- Premium Pricing Without Premium Perks: Customers expected more flexibility and perks at the price point Volvo set. For the cost, many users assumed they would have options like concierge services, free upgrades, or shorter-term flexibility, but these features were not included.

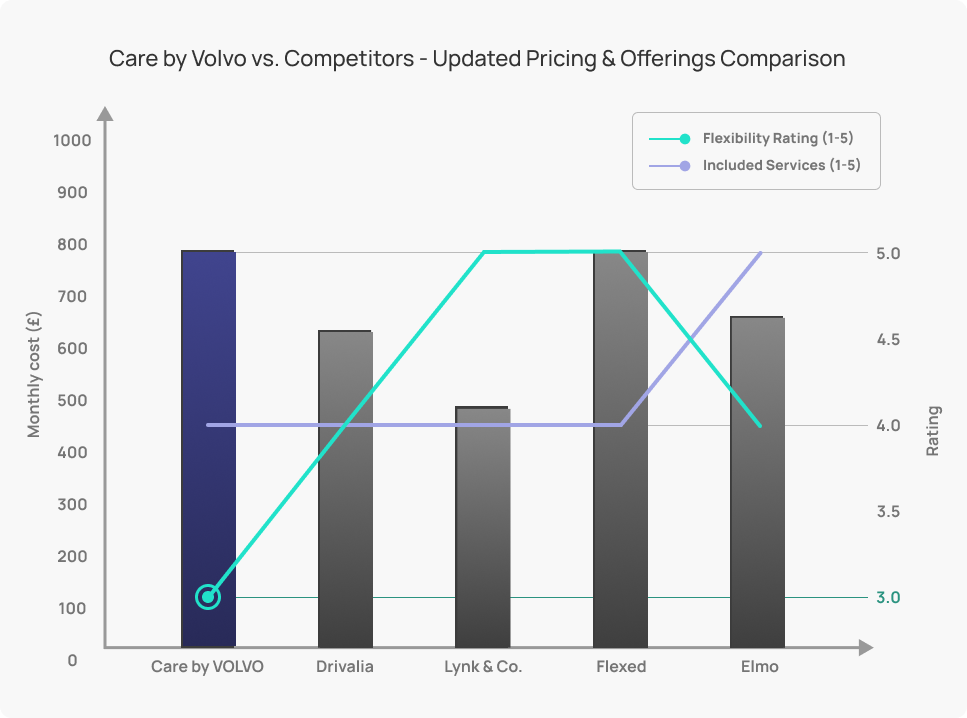

- Competitor Pricing Was More Attractive: Other brands managed to bundle affordability with flexibility, offering a more compelling value proposition.

- Market Mismatch: While subscriptions appeal to high-income, convenience-driven consumers, they must still feel like they’re getting good value relative to financing or leasing options. Many potential customers found that for the same price or less, they could lease a Volvo and have greater control over ownership aspects such as vehicle equity and resale value.

- The Perception of ‘Bundled’ Costs: Many customers found that bundling insurance, taxes, and maintenance into one price was not necessarily a selling point if it drove up overall costs. In some cases, customers could source these services separately for less than the subscription fee.

The Challenge of Differentiation

One of the underlying issues Volvo faced with its subscription model was a lack of clear differentiation from leasing. Customers who examined the offering often found little reason to choose it over a traditional lease. Unlike subscription-focused brands, which positioned their service as an entirely new way to access cars, Volvo’s approach felt more like an adjusted leasing plan with fewer advantages.

Factors That Led to Little Differentiation:

- Lack of Custom Features: Other subscription services provide additional perks such as all-inclusive concierge services, access to multiple car models, or seamless digital management. Volvo’s model lacked these value-added elements.

- Consumer Confusion: Many potential customers did not fully understand how Care by Volvo differed from a lease, especially when both required credit check, fixed terms, and set monthly payments.

- Limited Awareness and Marketing Gaps: Some consumers were unaware that Care by Volvo was an option. Volvo's marketing efforts for the service were not as aggressive or well-communicated as those of subscription-focused competitors.

The graph above shows how Care by Volvo’s high cost and low flexibility placed it at a competitive disadvantage, while providers like Lynk & Co, Flexed, and Elmo provide more adaptable, cost-effective solutions. The data reinforces that competitive pricing and flexible subscription models are key to success in the car subscription market.

Industry Lessons from Volvo’s Exit

While Care by Volvo had the right idea in offering a subscription-based mobility alternative, its execution can teach us a lot about critical obstacles. The lack of dealer alignment, inflexible terms, high pricing, and weak differentiation from leasing all contributed to its struggles.

For OEMs and mobility providers looking to succeed in the subscription space, Volvo’s challenges offer valuable lessons:

- Align dealer incentives with the subscription model or develop direct-to-consumer sales strategies.

- Prioritise flexibility, including vehicle swaps, adjustable terms, and self-service options.

- Ensure competitive pricing that balances convenience with perceived value.

- Clearly differentiate subscriptions from traditional leasing by adding exclusive perks and features.

How to build a Successful Car Subscription Service as an OEM

Flexibility is key: One of the core reasons car subscriptions attract modern consumers is the promise of flexibility. Unlike traditional leasing or financing options, subscriptions are expected to provide greater adaptability, allowing users to tailor their experience to their needs. However, Care by Volvo lacked the essential flexibility elements that successful subscription models incorporate.

Essential Flexibility Features for Subscription Success:

- Shorter or Adjustable Contract Lengths: A key differentiator of subscriptions is the ability to avoid long-term commitments. While Care by Volvo had fixed terms, many other services like Porsche Drive allowed monthly flexibility, attracting customers who prefer commitment-free options.

- Self-Service Digital Management Tools: Consumers today expect full digital control over their subscriptions, subscription extensions, introducing self-service features and providing that digital autonomy is a major factor in customer retention.

Successful subscription providers understand that consumer expectations revolve around convenience, and the more control they give their users, the higher the likelihood of long-term retention. Future subscription models must integrate adaptability as a core component rather than an afterthought.

Aligning OEM and Dealer Incentives: One of the most significant challenges Care by Volvo faced was the misalignment between Volvo’s direct-to-consumer ambitions and the existing dealership network. Dealers viewed subscriptions as a threat to their traditional sales and financing models, leading to resistance in promoting and supporting the service. To create a sustainable car subscription business, OEMs must find ways to align dealer incentives or transition to a direct-sales model.

Possible Solutions for OEM-Dealer Integration:

- Revenue-Sharing Models: One way to mitigate dealer resistance is to structure subscriptions in a way that benefits dealerships financially. This could include commissions for every subscription initiated through a dealer or profit-sharing arrangements based on vehicle usage.

- Dealer-Operated Subscription Services: Instead of OEMs controlling subscriptions directly, dealerships could operate them under the manufacturer’s umbrella. This gives retailers more autonomy over pricing, contract terms, and inventory management, fostering dealer buy-in.

- Hybrid Approach (Dealership-Based and Direct-to-Consumer Subscriptions): Offering both direct and dealership-supported options allows customers to choose their preferred channel. This hybrid approach ensures that dealerships remain relevant while also providing OEMs with a pathway to direct subscriptions.

OEMs that rely on dealership networks must acknowledge that change in incentive structures is necessary. If the dealer network is unwilling to support subscriptions, manufacturers may need to invest in their own direct-to-consumer strategies, similar to Tesla’s model, which eliminates dealership involvement entirely.

Pricing strategies must Reflect Consumer Expectations: The success of any car subscription service depends heavily on how customers perceive value. Unlike leasing, which is structured around ownership over time, car subscriptions are perceived as paying for convenience. This means pricing strategies must be designed to reflect this perception rather than simply bundling costs into a single monthly payment.

Key Pricing Considerations for Car Subscriptions:

- Balancing Affordability and Premium Features: Subscription customers are willing to pay a premium for convenience, but there is a limit. If a subscription is priced too high compared to leasing or financing, it becomes unappealing. Successful providers find the right balance, offering premium features while keeping costs reasonable.

- Leveraging Vehicle Lifetime Value (VLV) for Optimised Pricing: Instead of simply setting a monthly price based on lease-like models, OEMs should consider vehicle lifetime value. By incorporating factors like resale potential, service revenue, and customer retention, pricing can be structured to maximise long-term profitability.

Customers don’t just compare subscription pricing to leasing, they evaluate whether the service is worth the premium in exchange for convenience and flexibility. OEMs need to construct pricing strategies that reflect the unique advantages of subscriptions rather than simply repackaging leases with bundled services.

The car subscription market continues to evolve, with new players refining their models to better meet consumer expectations. While Care by Volvo faced significant challenges, its exit offers valuable insights for other OEMs and mobility providers. Flexibility, dealer alignment, and strategic pricing are three pillars that determine the success of a subscription model. Future car subscription services must prioritise adaptability, ensuring customers have control over their plans. They must also find ways to integrate dealers into the model, or move towards a direct-to-consumer approach that eliminates dealership resistance. Finally, pricing strategies should reflect the true value of convenience rather than simply rolling traditional costs into a subscription fee.

Why Car Subscriptions Still Have Potential

Despite the challenges faced by Care by Volvo, the car subscription market remains a rapidly expanding sector, with analysts projecting significant growth in the coming years. This trajectory indicates that consumer demand for flexible vehicle access models is still strong, and the industry as a whole continues to evolve and refine its approach.

The growing interest in car subscriptions for businesses is driven by shifting consumer preferences, particularly among younger, urban, and high-income demographics who value convenience and flexibility over long-term vehicle ownership. Younger generations living in cities are less inclined to own cars due to parking constraints, rising insurance costs, and evolving transportation alternatives. Car subscriptions offer a compelling solution for those who need access to a vehicle without the burdens of ownership. Additionally, consumers have grown accustomed to the flexibility offered by subscription-based services in other industries This same expectation applies to vehicle access, where users seek seamless, commitment-free mobility solutions. Furthermore, with the rapid growth of electric vehicles (EV's) and evolving government regulations on emissions, many consumers are hesitant to commit to a long-term vehicle purchase. Car subscriptions provide a way to experience EV's without long-term financial risk, encouraging broader adoption.

Volvo’s exit from the car subscription space should not be seen as an indictment of the subscription model itself but rather a case study in the importance of execution. The fundamental appeal of car subscriptions remains intact, but success requires careful structuring of pricing, flexibility, and dealer integration.

By addressing these key areas, OEMs and mobility providers can build sustainable subscription offerings that resonate with modern consumers. The failure of one implementation does not invalidate the entire concept - rather, it offers valuable insights into how subscriptions can be refined for future success.

Final Thoughts

The Care by Volvo subscription model aimed to revolutionise vehicle access but struggled with execution, leading to its recent withdrawal from several markets. Key challenges included resistance from dealers, lack of flexibility, and pricing misalignment. Traditional dealerships saw subscriptions as a threat to their revenue, making adoption difficult. The service also lacked adaptability, with fixed-term contracts and no vehicle swap options, limiting its appeal. Additionally, its premium pricing failed to offer enough perceived value compared to alternatives.

Despite these setbacks, Care by Volvo provides valuable lessons for OEMs and mobility providers. Flexibility is essential - consumers expect adaptable plans, vehicle swaps, and self-service features. OEMs must also align dealer incentives or consider direct-to-consumer models. Pricing strategies should clearly communicate the added convenience and benefits over traditional leasing.

The future of car subscriptions still remains promising. The growing preference for on-demand mobility, coupled with evolving automotive trends such as EV adoption and digital transformation, suggests that subscriptions will continue to be a viable alternative to traditional car ownership. The projected market growth of $12.1 billion by 2027 underscores the potential for well-structured subscription services to thrive.

As the industry refines its approach, the next generation of car subscriptions must prioritise consumer-centric design, seamless digital management, and pricing strategies that align with perceived value. The failure of Care by Volvo is not the end of car subscriptions, it is a learning opportunity that paves the way for more effective and sustainable models in the years to come.

Explore Our Latest Insights

Discover trends and innovations in the automotive sector.